tax benefit rule calculation

If that deduction wasnt taken you would have claimed the 12600 standard deduction. Most countries define maximum amortisation rates or minimum number of years in which the amortisation of intangible assets can be deducted if at all.

Income Tax It Returns Rules What Is Income Tax For Fy 2021 22

Its deductibility depends on the corporate income tax legislation of single countries.

. So the tax benefit you received from the 300 refund was only 225. The TAB is calculated by using a two-step procedure. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the earlier year.

So if you owed 1500 in taxes and then took a 1000 credit your tax bill would be 500 1500 -. If you had a direct expense of 200 to paint the office you could add this amount to the indirect expense total of 2100 to give a total expense deduction of 2300. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600.

With the figure we can determine which form of tax is applied based on the purchase price. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The steps are shown below.

You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee. The entire amount recovered in the current year had given the taxpayer a tax benefit. The rule is promulgated by the Internal Revenue Service.

The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later and not paying taxes on it. 375 6 years 2250. Of course if you were not able to itemize for 2012 none of your state tax refund is taxable for 2013.

A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a subsequent yearthe money must be counted as income in the subsequent year. Suffers a fire a few days after completion of a building that cost 500000 to build. 2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayers federal income tax return.

The Central Board of Direct Taxes Chairman PC Mody says that the new tax regime offers lower slabs without exemptions. Value the asset in the absence of amortisation benefits. The tax benefit rule requires Company XYZ to report the 100000 as income on its 2010 tax return and pay taxes on it.

State Local Tax SALT In Rev. If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax deduction versus the 13000 you actually claimed.

The tax credit reduces your tax bill by that same 1000. If the full 5000 refund were disallowed their limited tax deduction under the TCJA would drop to 9000 from 10000 resulting in an increase in taxable income and an increase in tax that can be traced to 1000 of the refund. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

1500 x 0025 375. That results in a 400 difference which is your tax benefit. The business mileage rate for 2022 is 585 cents per mile.

15000 2275 144750 de minimis threshold The calculation above that the de minimis threshold is 147750. Due to this rule a state or local income tax refund may not be entirely taxable if the taxpayer claimed unused tax credits or was subject to the alternative. What form of tax will be applied once the bond is sold.

Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if marked as deductible Prepaid Interest Points X decimal form of tax bracket all divided by 12 to get monthly benefit. IRC 111 would still serve to exclude 4000 of the refund from their 2019 income. Under the so-called tax benefit rule a taxpayer need not include in his gross income and therefore need not pay tax on it amounts recovered for his loss if he did not receive a tax benefit for the loss in a prior year.

Dividing this by the marginal tax rate for regular tax purposes 28 results in 646 the approximate amount of income taxes that did not produce a tax benefit. Equivalently stated taxpayers must include in income any amounts recovered if they received a tax benefit in a prior year for that loss. Why Does a Tax Benefit Matter.

This is accomplished by calculating the discounted present value of the after tax cash flows attributable to the asset where the cash flows do not reflect amortisation charges in the tax calculation. The following table displays the legal tax amortisation life times in years of the main types of intangible. According to the new budget individual taxpayers can switch back and forth between the new tax regime and the old structure.

The tax benefit shown in the summary section is defined by the following equation. C received a tax benefit from 500 of the overpayment of state income tax in 2018. Thus C is required to include.

This is because the amount deducted for income taxes that reduces regular tax to or below the AMT level does not produce a tax benefit because the AMT does not allow the deduction. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must be included in gross income in the subsequent period. Note however that the tax benefit rule does.

The new income tax calculations were announced with the new budget on 1 st February by FM Sitharaman. Since we previously determined that the business portion of the house is 10 of the total then the office-in-home expense is 21000 x 10 2100. Of state income tax in 2018 Cs state and local tax deduction would have been reduced from 10000 to 9500 and as a result Cs itemized deductions would have been reduced from 15000 to 14500 a difference of 500.

How Is Taxable Income Calculated

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate Standard Deduction In Income Tax Act Scripbox

What Is The Formula To Calculate Income Tax

Section 80d Deductions For Medical Health Insurance For Fy 2021 22

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

How To Calculate Standard Deduction In Income Tax Act Scripbox

Tax Benefits U S 80d How To Divide Health Insurance Premium To Claim Deduction For More Than 1 Year The Financial Express

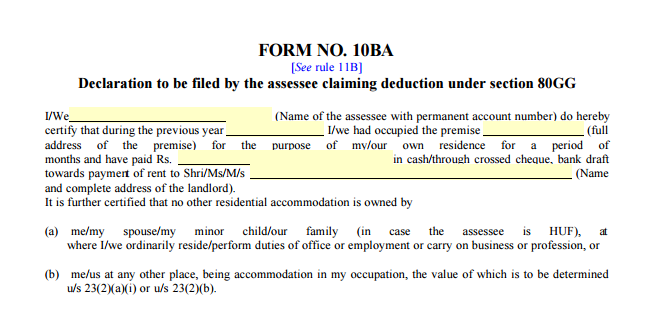

80gg Tax Benefit For Rent Paid

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Hra Exemption Rules Hra Deduction Hra Calculation Hra Tax Saving

Social Security Benefits Tax Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Hra Exemption Rules Hra Deduction Hra Calculation Hra Tax Saving

Hra Calculator Know How To Calculate House Rent Allowance

Income Profession Tax Benefits For Disabled Handicapped Persons

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics